How to improve Customer Lifetime Value?

null • Apr 29, 2024

Alexandra Augusti

Strategy & Operations Manager

The importance of customer lifetime value (CLV or LTV) cannot be underestimated in today's business environment. Nurturing and enhancing the value of existing customers is often more cost-effective than acquiring new ones. Therefore, it is crucial for companies to implement effective strategies to reduce churn, promote loyalty, and maximize the lifetime value of their customers.

👉🏼 Let's take a moment to detail all strategies that can be implemented to increase LTV, a key CDP use case.

Understanding Customer Lifetime Value

Customer Lifetime Value represents the net revenue a customer contributes to a business over their entire relationship. Maximizing LTV is essential to ensure profitability and, more importantly, business growth.

For relevance, LTV should be compared to associated costs of maintaining the customer. This includes the cost of customer acquisition (CAC), customer service costs, marketing and sales expenses, and customer relationship management costs. By understanding these elements, you can assess profitability and identify optimization opportunities.

One advantage of LTV is that it accounts for customer loyalty, their propensity to purchase more products or services over time, and their likelihood of remaining a customer in the long term.

A key to maximizing customer lifetime value is providing a highly personalized customer experience. By offering quality customer service, anticipating customer needs and concerns, and providing high-quality products or services, you can foster customer loyalty and encourage them to make more purchases. Investing in customer relationships can increase your clients' LTV and ensure business growth.

Calculating LTV

Calculating LTV is straightforward but requires certain information about your customers:

Average order value

Purchase frequency

Average customer lifespan*

The LTV formula, therefore, is the multiplication of the average order value by the purchase frequency and the average customer lifespan.

*The average lifespan of a customer is a crucial component of the LTV calculation. Here are some common methods to estimate it:

Cohort Analysis: This method involves grouping customers into cohorts based on their acquisition date. These cohorts are then tracked to see how long customers remain active before disengaging.

Survival Models: These models treat customer churn as an "event" and analyze the time until this event occurs, considering various explanatory variables.

Retention Rate Calculation: A more straightforward approach is to use the annual retention rate to estimate the average lifespan. For example, if the retention rate is 80%, the average lifespan can be roughly estimated as 1/(1 - 0.80) = 5 years. This method is simple yet effective for a quick estimate.

Strategies to Maximize Customer Lifetime ValuePersonalizing the Customer Experience

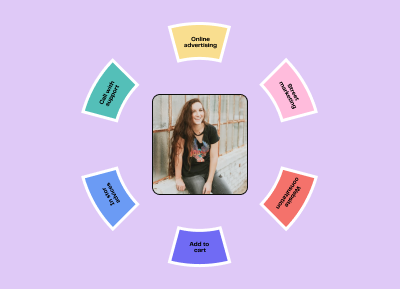

One of the most effective strategies to maximize the lifetime value of customers is to personalize their experience as much as possible. By understanding your customers' needs, preferences, and behaviors, you can offer tailored promotions and services. Personalizing the customer experience can involve product recommendations based on purchase history or customizing marketing communications.

Loyalty Programs and Rewards

Implementing a loyalty program and rewards can be another effective strategy to maximize customer lifetime value. By rewarding repeated purchases, referrals, or participation in special events, you can encourage customers to remain loyal to your brand and increase their average order value.

Proactive Communication and Customer Engagement

Proactive communication and regular customer engagement are essential to maximize customer lifetime value. By staying in touch with your customers, offering updates on your products or services, soliciting their feedback, and addressing their queries, you can strengthen customer relationships and enhance their satisfaction.

Optimizing the Shopping Experience

Optimizing the shopping experience is another key lever to maximize customer lifetime value. Think omnichannel! The experience should be seamless and unified, whether online or offline.

By simplifying the buying process, offering flexible payment options, providing satisfaction guarantees, or facilitating returns and exchanges, you can improve customer satisfaction and encourage repeated purchases. The shopping experience should be smooth, intuitive, and enjoyable to encourage customers to return and recommend your brand to others.

The Emergence of AI in Optimizing LTV

Artificial intelligence (AI) has become an indispensable tool for businesses looking to optimize their processes and provide ultra-personalized, optimized customer experiences. AI is your new ally if you want to maximize the LTV of your customers.

Enhancing Personalization Through AI

AI can be used to analyze customer data and generate personalized recommendations based on buying preferences and behaviors. By employing machine learning algorithms, companies can create unique customer experiences tailored to each individual. Recommendations are generally more precise when generated by AI.

Optimizing Marketing Campaigns with AI

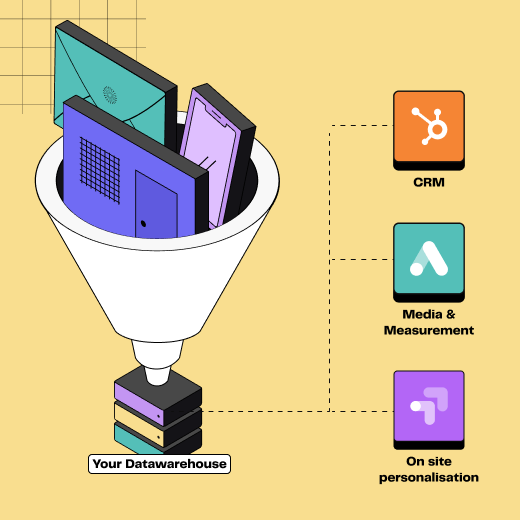

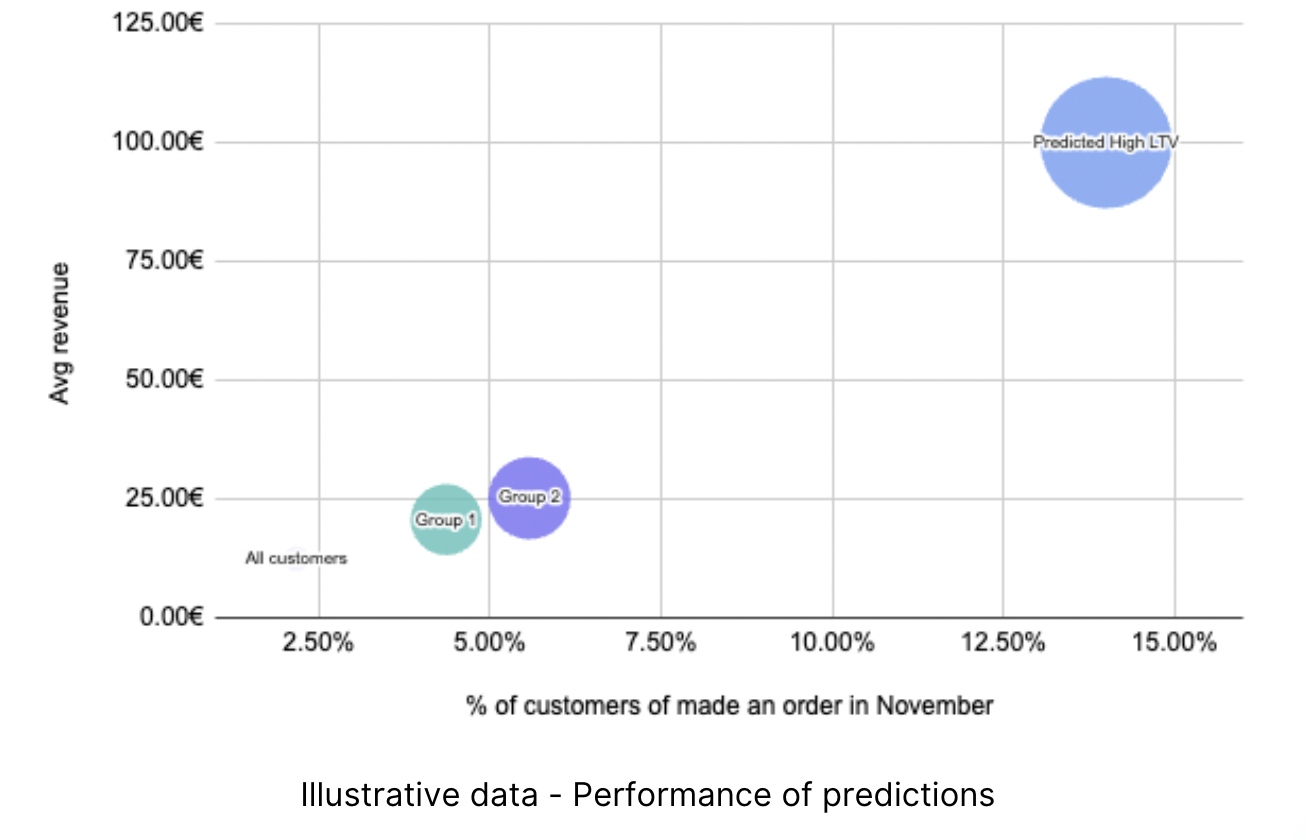

AI can also be used to optimize marketing campaigns by identifying the most profitable customer segments and tailoring messages accordingly.

AI is used for various tasks in digital marketing, regardless of the targeted stage in the customer lifecycle. AI helps to reduce customer acquisition costs (CAC), increase purchasing periods, and average revenue, especially by:

Defining the Target Audience: To maximize a customer's lifetime value, it's essential to address them at the right time with the right message, considering their stage in the lifecycle. Segmenting your customer base is therefore crucial for effectively targeting your audience. AI can assist in finding relevant segments.

💡 At DinMo, we complement the customer view with predictive indicators (retention, expected additional LTV, etc.), which can be used for segmentation. To find out more, read our Galeries Lafayette case study.

Using Audience Signals: By using advanced analytics tools and AI, you can collect, analyze, and interpret audience signals to make strategic decisions based on reliable data. Understanding your customers' needs and expectations allows you to personalize their experience, anticipate their future needs, and strengthen their engagement with your brand.

Optimizing Algorithms: Advertising giants obviously use AI and machine learning techniques to optimize their algorithms, especially in cases of "Smart Bidding." They are increasingly effective at targeting individuals likely to convert, thus optimizing outcomes.

⚠️ However, be sure to clearly define the objective of your campaign! For instance, if the goal of a campaign is to generate leads, the algorithm is optimized to maximize form submissions. However, the quality of the lead is not guaranteed!

Content Writing and Asset Optimization: A well-organized campaign structure and attractive creative assets can enhance the effectiveness of your campaigns and increase the lifetime value of your customers. And for this, AI is your best ally! By combining a solid campaign structure with high-quality creative assets, you can maximize the impact of your marketing campaigns and achieve your goals more easily.

Improving Customer Experience Through AI

AI can also be used to enhance the customer experience by providing quick and personalized responses to client inquiries. AI-powered chatbots can address customer requests in real-time, improving customer satisfaction and reducing wait times. By employing chatbots to handle customer interactions, businesses can offer 24/7 customer service and enhance the quality of the customer experience.

What KPIs to Track to Ensure Strategy Effectiveness?

To evaluate the effectiveness of strategies aimed at improving a customer's lifetime value, it is important to monitor specific KPIs. Here are some key indicators:

LTV: Comparing LTV across different time periods allows you to monitor the outcomes.

Customer Acquisition Cost (CAC): It's important to regularly compare CAC to LTV to ensure that the cost of acquiring a customer remains economically justifiable relative to the value they bring.

Retention Rate: A crucial KPI that measures the percentage of customers who remain active over a given period compared to an earlier period. An increase in retention rate often indicates an improvement in LTV.

Purchase Frequency: Measuring how often customers return to make purchases helps assess the effectiveness of re-engagement and loyalty strategies.

Average Order Value (AOV): Tracking whether the transaction value per customer is increasing can indicate an increase in LTV due to greater spending per visit.

NPS (Net Promoter Score): This score helps measure customer satisfaction and loyalty. A high NPS is often a good predictor of high LTV, as satisfied customers tend to spend more and stay longer.

Regularly tracking these measures can provide valuable insights into the effectiveness of initiatives taken to maximize customer LTV. They also allow for continuous adjustment of strategies based on the outcomes to optimize return on investment continuously.

Conclusion

In conclusion, Customer Lifetime Value (LTV) is an essential indicator that not only measures a customer's financial contribution over time but also serves as a guide for directing marketing and customer service strategies. By adopting a methodical approach to calculating and maximizing LTV, including sophisticated data analysis and strategic use of artificial intelligence, businesses can strengthen customer loyalty, optimize acquisition spending, and ultimately increase profitability.

If you need assistance reducing your acquisition costs and optimizing your LTV through the activation of your customer data, do not hesitate to contact us.